Income Inequality

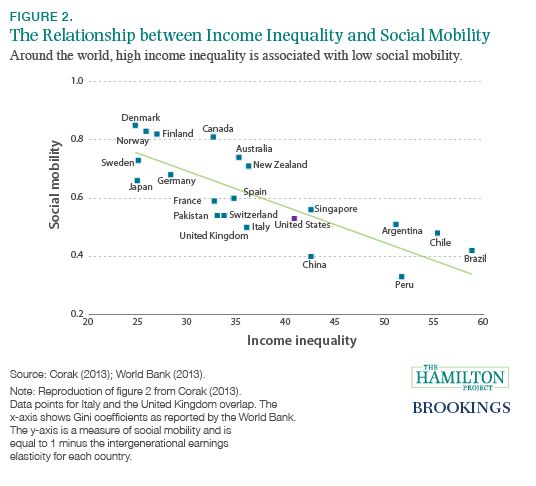

The Hamilton Project has done a study on how income inequality social mobility and education. As you can see by the chart; Americans making less aren't moving above their economic status. In America the Haves have more and the have nots are getting poorer.

The Hamilton Project has done a study on how income inequality social mobility and education. As you can see by the chart; Americans making less aren't moving above their economic status. In America the Haves have more and the have nots are getting poorer.

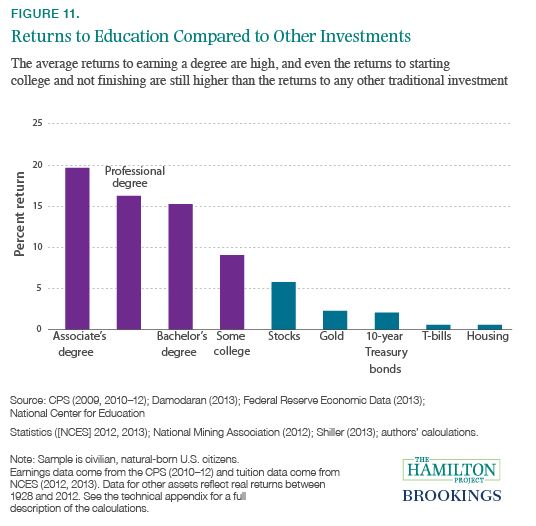

Figure 1 illustrates the diverging fortunes of children based on their family’s income, as measured by the U.S. Census Bureau. Children in families at the top of the income distribution have experienced sizable gains in their families’ incomes and resources since 1975. Children living in the top 5 percent of families, for instance, have seen a doubling of their families’ incomes. But such gains have been more modest for children in the middle of the distribution, and children living in lower-income families have experienced outright declines in incomes. In fact, in 2011 the bottom 35 percent of children lived in families with lower reported incomes than comparable children thirty-six years earlier.The Hamilton Project compared a college education to other investments. The findings show it makes financial sense to further the education of young people.

What will hurt the future of education America's young people is the increase in student loan debt.

What will hurt the future of education America's young people is the increase in student loan debt.

Over the past decade, the volume and frequency of student loans have increased significantly. The share of twenty-five-year-olds with student debt has risen by about 15 percentage points since 2004, and the amount of student debt incurred by those under the age of thirty has more than doubled (Lee 2013). Despite these increases, the majority of students appear to borrow prudently. About 90 percent have loan balances less than $50,000, and 40 percent have balances under $10,000 (Fry 2012). Given that a college graduate can expect to earn, on average, about $30,000 more per year than a high school graduate over the course of his or her life, the returns to college appear to warrant the cost of student loans for most students.House Republicans wanted to raise student loan rates from 3.4 to 8.5 and let rates fluctuate with increases in Tresury notes. Democrats wanted to wanted to lock in rates at 3.4 percent for another two years. House Speaker recessed without bringing up student loan rates. Boehner spent the week failing to pass the Farm bill. We have one of the two major political parties helping cause income inequality by making college education too expensive for students.

Labels: economics, economy, education, income inequality

1 Comments:

Baca Juga !!!

Tafsir Buku Mimpi

Prediksi Togel Jitu

freebet bola

Prediksi Hari ini

raja freebet

situs slot

Live Draw Cambodia

Post a Comment

Subscribe to Post Comments [Atom]

<< Home